MacroInsight / Click here for full PDF version

Author(s): Luthfi Ridho ;Axel Azriel

- CPI recorded inflation of +0.08% mom/+1.71% yoy in Oct24 (-0.12% mom/+1.84% yoy in Sep24) mainly from FnB and health prices.

- Core CPI rise to +0.2% mom/+2.2% yoy, supported by gold jewelry and coffee with +0.4% and +0.1% contribution.

- We maintain our inflation expectation at c.+2.1% in FY24 (2.6% in FY23) as we expect economic activity growth to pick-up in 4Q24.

Higher FnB prices led by chicken meat

Headline CPI recorded inflation of +0.08% mom/+1.71% yoy in Oct24 (-0.12% mom/+1.84% yoy in Sep24), a tad higher than consensus at +0.02% mom/+1.66% yoy but roughly aligned with ours at +0.11%mom/+1.96% yoy. This was the first monthly inflation in 6 months, but not a tangible indication of purchasing power recovery since the figure was considerably low in our view. Concurrently, the CPI was contributed from health costs at +0.15% mom/+1.71% yoy and FnB prices at +0.1% mom/+2.4% yoy as the price of onion and chicken meat rose the most by +10.7%/+7.2% mom or +27%/+4.4% yoy. In addition, our channel check on the chicken meat prices suggested that the supply of chicken meat was affected by massive parent-stock (PS) culling in 3Q24. Hence, we see the chicken price may rise further in 4Q24 (see our poultry reporthere).

Core CPI surged from rising gold jewelry price

Core CPI rose to +0.22% mom/+2.21% yoy in Oct24 (+0.16% mom/+2.1% yoy in Sep24), surpassing headline CPI amid weaker administered and volatile prices at -0.25%/-0.11% mom or +0.77%/+0.89% yoy (-0.04%/-1.34% mom or +1.4%/+1.43% yoy in Sep24) - see fig. 4. The increase in core CPI was primarily driven by gold jewellery, contributing the most to headline CPI at +0.4%, align with persistent increase of gold price at 4.2% mom/38.3% yoy in Oct24. Other core CPI such as household utilities decelerated to +0.06% mom/+1.1% yoy (+0.12% mom/+1.1% yoy in Sep24).

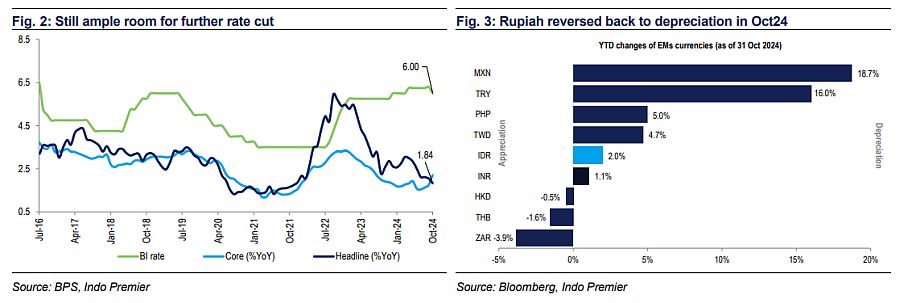

Further BI rate cut still justified but contingent on Fed meeting

Overall, we see the inflation figure to be benign and soft. We believe further BI rate cut by 25bp in Nov24 meetings to be justified. However, we believe the Fed meeting in 6-7th Nov will have influence on BI's decision in 19-20th Nov. Consensus views the Fed will cut the FFR by 25bp. If happen, we see similar decision on the BI rate as the downward adjustment may stimulate economic activity without sacrificing the Rupiah stability. For now, we keep our inflation expectation to be at c.2.1% in FY24 (+2.61% yoy in FY23), as we believe a higher economic activity growth may happen in 4Q24.

Sumber : IPS