Sector Update / Banks / Click here for full PDF version

Author: Jovent Muliadi ; Anthony

- Big 4 banks have dropped 11% from its peak, this was similar to previous years (2018-2022) trend of -10 to -15% drop during Apr-May period.

- We think this was the combination of: 1) weak 2M24 results, 2) depreciating currency and 3) higher-for-longer rate expectation.

- We think this situation is quite similar to 2019 as: 1) election years, 2) currency depreciation and 3) earnings growth profile. We prefer to wait until 1Q shall there be any earnings downgrade but maintain OW.

Steep correction in the last one month

Big 4 banks have fallen by -11% (SOE was deeper at -14%) from its peak. The initial sell-off trigger was disappointing 2M24 results (especially for and - link), it was exacerbated by depreciation in Rupiah by 2% in the last month along with expectation of higher-for-longer US interest rate given the sticky inflation. However, we have kind of expected this correction following weak Jan24 results (link) and surprised that the flow continued to remain strong despite the weak set of results.

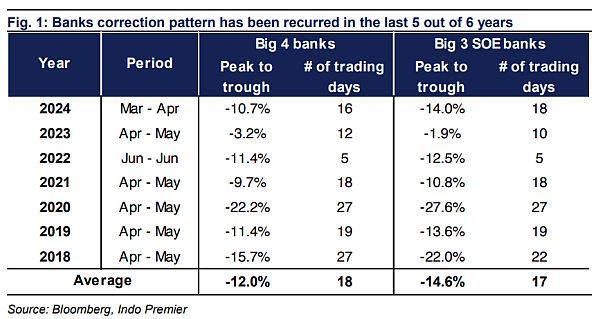

The correction pattern is keep repeating itself

The mid-year correction pattern has been recurred in the last 5 out of 6 years (except 2023 given the stellar earnings since 1Q23). The average correction during 2018-2022 was between -10 to -15% (Covid at -22%) from peak to trough and comparable to current sell-off at -11%. Hence we think this is just a seasonal recurring pattern and almost all the sell-off coincided with weaker currency. We think the assumption of continuous weakening in Rupiah is unwarranted given: 1) higher FX reserve level, 2) healthier current account deficit and 3) lower exposure on foreign ownership in government bond.

We think the current cycle is more similar to 2019

Our analysis suggest that the current cycle is quite similar to 2019 on 3 fronts: 1) both are election years, 2) currency depreciation (2019 Rupiah depreciated by 3% during the sell-off), 3) tight liquidity condition (LDR at 90% in 2019) and 4) similar earnings profile - the last point is really important to be highlighted as 2019 was the slowest banks' earnings growth in the last 6 years (excluding Covid) at only +8%. For 2024, we/consensus are expecting banks to generate +13/10% earnings growth vs. 2M24 growth of -2%, which we think shall be hard to achieve and thus, we think post 1Q results, we are going to see downgrade across big banks (especially SOE). We believe that overall consensus earnings will be downgrade by around 4-6%, also similar to 2019 downgrades of c.5%.

We continue to like BCA and but prefer to wait until 1Q results

We don't think the current sell-off is structural - even we don't think spike in BRI credit costs to be structural factor, and instead we think this was a seasonal correction. However, we expect most banks (especially SOE, only BCA we expect to book relatively in-line results) will post relatively weaker 1Q results and thus, may be potentially followed by downgrades especially on NIM as all banks expect 50bp rate cut in 2H and to some extent CoC. We have liked BCA and since the beginning of the year despite differing from consensus given that liquidity was our biggest concern for this year. We continue to like both banks as we the results will be relatively better compared to its peers.

Sumber : IPS