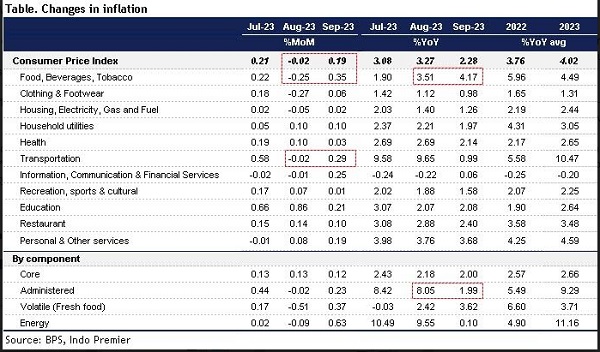

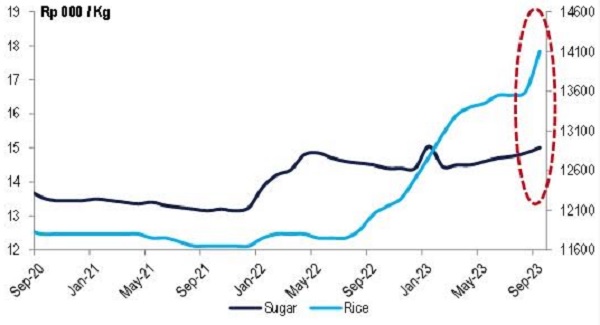

Headline CPI recorded at +0.19% mom/2.28% yoy in Sep23 (-0.02% mom/+3.27% yoy in Aug23),higher than consensus at +0.12%mom/+2.2%yoy (aligned with ours at +0.17mom/+2.26% yoy). The higher MoM inflation mainly comes from Fnb prices at +0.35% mom/+4.17% yoy (-0.25% mom/+3.51% yoy in Aug23), due to drought and bad harvest. Higher fresh food price was led by persistently *high rice price at c.+3.7% mom/+17% yoy in Sep23 (+0.4% mom/+14.8% yoy in Aug23).*

Core inflation recorded at +0.12% mom/+2% yoy in Sep23 (+0.13% mom/2.18% yoy in Aug23),mainly from education at +0.21% mom/+2.08% yoy. We believe increasing election related activities may induce stronger core inflation movement from more money circulation outside banking system (an increase of 15-20% in avg in previous elections).

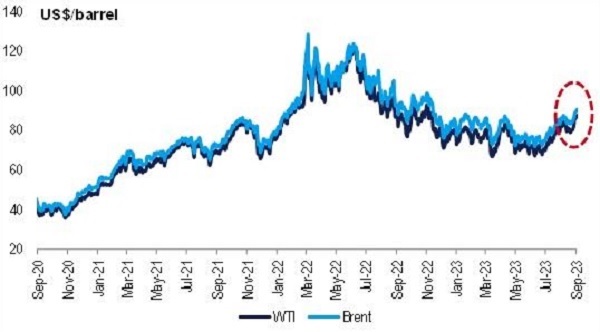

We expect inflation will be at c.2.5% yoy in FY23 (+5.51% yoy in FY22)on the back of lower than expected economic growth at c.+5.1% in FY23 (+5.3% in FY22). We are on the view that BI will keep its *policy rate unchanged at 5.75% in their meeting in Sep23*. For now, we keep our BI rate expectation at 6.0% by year-end (+0.25bp increase in Nov-Dec), primarily to guard the interest rate parity and currency stability. (IndoPremier Research)

Sumber : IPS