Sector Update / Banks / Click here for full PDF version

Author(s): Jovent Muliadi ; Anthony

- In recent weeks there have been concerns on the SOE banks' exposure on SOE contractors namely and .

- While has so far been well provisioned, we found that minimal provision on . Currently we only expect restructuring and hence, lower NIM instead of spike in CoC.

- We expect the base case impact shall be only 1.5-3% EPS drop for SOE banks. Worst case impact will be 5-13% EPS drop. BRI is clear winner.

Risk in contractors exposure especially on and

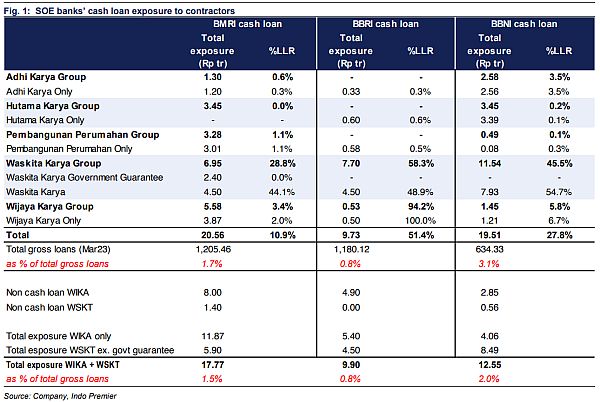

In recent weeks there have been concerns on SOE banks' exposure on SOE contractors especially and . While has been well covered at 45-60%, exposure on hasn't been provisioned enough (less than 10%) except for BRI at 100% for the cash loan. We estimate total and exposure (including non-cash loan exposure but excluding govt guarantee loan) for SOE banks at Rp9.9/12.6/17.8tr for /BBNI/BMRI or 0.8/2.0/1.5% of its overall loan book (details on fig 1).

Base case of restructuring is relatively muted for all banks' EPS

We believe that the restructuring will happen and unlikely banks need to set aside full provision for both and . Hence, our base case expect that both and to stay in performing category (instead of non performing) but with significantly lower interest rate (i.e. Garuda restructuring scheme); even with as low as 0.5% interest rate for and (including cash loan and all non-cash loan is converted to cash loan) we found the impact to EPS will be only 1.5-3% (c.10bp NIM impact) - fig 2.

Worst case impact is taking into account additional provision and conversion of non-cash loan

We also run another assessment to estimate the additional provision of which we run two scenarios: 1) for the first scenario, we expect provision to go up to 70% and provision goes up to 35% and only 25% of non-cash loan converted to cash loan; the additional EPS impact from higher provision will be -1.8/-5/-7% for /BMRI/BBNI - fig 3. 2) For the second scenario, we expect provision to go up to 70% and provision goes up to 35% but 100% of non-cash loan converted to cash loan; the additional EPS impact from higher provision will be -3.4/-8.6/-9.7% for /BMRI/BBNI. - fig 3. Note that our calculation doesn't take into account the FY23 provision budget that the banks have set aside for both and .

BRI is the clear winner here; and seem to be exposed but have set adequate FY23 provision budget to absorb the impact

Given the peaking interest rate and relatively minimal exposure (also ample provision) on these contractors, BRI is the clear winner here. That being said, while /BBNI are seems to be exposed here, in absolute amount of provision that needs to be set aside of Rp2.5/1.4tr for scenario 1 can be allocated or even prioritized given that it has budgeted c.Rp19/10tr for FY23 provision (c.13/15% of total FY23 provision budget). For now we only expect NIM impact but no CoC impact. Our top pick stays with and for this year. Main risk will be more SOEs that need to be restructured.

Sumber : IPS