Company Update / Banks / IJ / Click here for full PDF version

Author(s): Jovent Muliadi ;Anthony

- 9M24 net profit of Rp45.1tr (+2% yoy), in-line at 72/74%. PPOP /NII also came in-line with ours (75/76%).

- CoC stood at 3.2% in 3Q24 vs. 3.1% in 2Q24, but note that bank-only CoC dropped to 2.9% vs. 3.2% in 2Q24; spike in PNM was temporary.

- Asset quality outlook has improved with lower sequential downgrade, on-track restructuring progress and better vintage for 2024's Kupedes. This re-affirm our cyclical not structural thesis, reiterating BRI as our top pick.

9M24 results: in-line with tangible improvement in asset quality

posted 9M24 net profit of Rp45.1tr (+2% yoy/+11% qoq), which came in-line at 72/74% of our/consensus FY24F estimates. PPOP growth remains strong (+11% yoy/+16% qoq) supported byrobust non-II (+29% yoy/+22% qoq - this was driven by recovery) and NII (+5% yoy/qoq) but offset with rising opex (+11% yoy/+3% qoq). Provision rose by +28% yoy/+41% qoq translating to overall CoC of 3.4% in 9M24 vs. 3.5% in 1H24.It kept the CoC guidance unchanged at 3% for FY24 as it foresees improving downgrade rate, on-track micro restructuring progress along with the quality and better vintage quality for 2024's Kupedes; we project FY24 CoC to be 3-3.1% before improving to 2.7-2.9% in FY25F.

Improving qoq NIM

Overall NIM improved qoq to 7.7% in 9M24 vs. 7.6% in 1H24, in-line with management's FY24F target of 7.6-8% mainly due to higher LDR at 89% in 3Q24 (vs. 87% in 2Q24). Deposit grew by +6% yoy/-2% qoq supported by both (+6% yoy/flat qoq) and TD (+4% yoy/-5% qoq).

Expected sluggish loan growth

Overall loan growth slowed down to +8% yoy in 3Q24, below its target of 10-12% partly due to slower micro growth (+6% yoy/+1% qoq) amid the focus on asset quality and base effect in corporate segment (+14% qoq in 3Q23 before declined -5% qoq in 4Q23). It guides for loan to be on the lower end of the guidance which still primarily driven by corporate.

Tangible improvement in asset quality

Consolidated NPL improved by -20bp yoy/qoq to 2.9% mainly from corporate segment (-214bp yoy/-55bp qoq) while micro segment was stable qoq at 3%.Worth noting that bank-only CoC continued to trend down to 2.9% in 3Q24 vs. 3.2/3.8% in 2Q/1Q24despite minimal drop in consol level CoC of 3.2% in 3Q24 vs. 3.1/3.8% in 2Q/1Q24, this was attributed to front-loading on PNM as PNM CoC spiked to 7.6% in 9M24 vs. 6.1% in 1H24 though this shall only be temporary as it expects FY24 CoC for PNM to be at 7%.2024's Kupedes vintage also suggest tangible improvement, suggesting improvement on its business process has started to bearing some results. At the same time, LAR now stood at 11.7% in 3Q24 vs. 13.8/12.0% in 3Q23/2Q24 with LAR coverage of 53.6% in 3Q24 vs. 50.9/53.9% in 3Q23/2Q24.

Maintain Buy amid attractive valuation and asset quality inflection

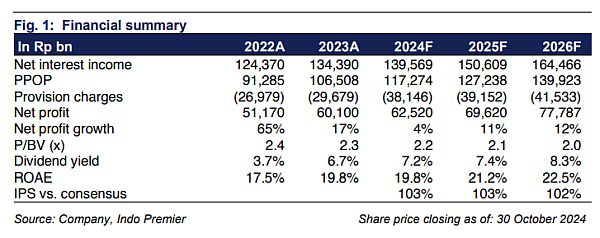

currently trades at 2.1x FY25F P/B (vs. 10Y avg. of 2.4x) and 10.3x FY25F P/E (vs. 10Y avg. of 14.7x).Note that stock price plummeted to Rp4.1-4.2k post 1Q results with the assumption that Kupedes is a structural issue with no clear recovery timeline; as such, given the tangible recovery and confirmation that this isn't structural factor, we think current price may represent the trough. Reiterating BRI as our top pick.

Sumber : IPS