Company Update / Banks / IJ / Click here for full PDF version

Author(s): Jovent Muliadi ; Anthony

- 's 1Q24 net profit of Rp12.9tr (+12% yoy) was in-line with estimates (at 24%) driven by strong PPOP and lower provision.

- NIM was stable (yoy/qoq) at 5.6% in 1Q24 despite rising CoF environment and in-line with its target.

- LAR continued to trend down to 6.6% vs. 9.5/6.9% yoy in 1Q23/4Q23 with rising overall coverage. Maintain Buy with unchanged TP.

1Q24 results: in-line from strong loan growth and asset quality

posted 1Q24 net profit of Rp12.9tr profit (+12% yoy), in-line at 24% of our/consensus FY24F estimates. PPOP grew by 8% yoy driven by NII and non-II (both at +7% yoy) and mild opex growth (+4% yoy). Provisions dropped -30% yoy amid stellar asset quality. This translate to credit costs of 0.4% in 1Q24 (0.8/0.3% in 1Q23/FY23), in-line with its FY24F CoC guidance of 0.3-0.4%.

Stable NIM in 1Q24 despite rising CoF environment

NIM was flattish at 5.6% vs. 5.6/5.5% in 1Q23/FY23 as higher CoF (+20bp yoy/flat qoq) was offset by better asset yield (+10bp yoy/-20bp qoq) and higher LDR which stood at 75% in 1Q24 vs. 69/74% in 1Q23/4Q23. It maintains FY24F NIM guidance of 5.5-5.6%. Deposits grew by +8% yoy (+2% qoq), driven by TD (+11% yoy/flat qoq) though (+7% yoy/+2% qoq) has gradually been improving - contrary to its peers.

Robust loan growth from all segments

Loan rose 17% yoy (+3% qoq) driven by all segments. The growth was led by corporate (+22% yoy/+6% qoq), followed by consumer (+15% yoy/+2% qoq), SME (+13% yoy/+2% qoq) and commercial (+9% yoy/-1% qoq). However, it maintains FY24F loan growth target at 9-10% which we think is too conservative.

LAR continued to trend down which led to low CoC

NPL stood at 1.9% in 1Q24 vs. 1.8/1.9% in 1Q23/4Q23 while total LAR continued to trend down in both yoy and qoq basis (6.6% in 1Q24 vs. 9.5/6.9% in 1Q23/4Q23). LAR coverage also stood at 71.9%, higher than 57.8/69.7% in 1Q23/4Q23. It guides for LAR to trend down to 4-6% level..

Maintain Buy with unchanged TP

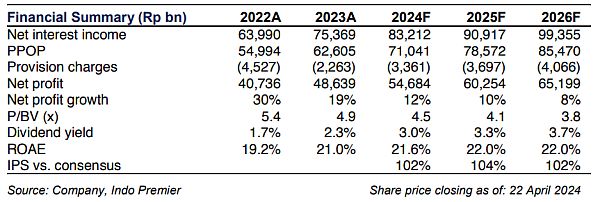

We continue to like and maintain our Buy call following its strong set of results; of which we think the best among big 4. currently trades at 4.5x P/BV vs. 10Y avg of 3.8x but we believe that the premium is justified. Risk to our call is weaker NIM from competition in lending.

Sumber : IPS