Sector Update / Banks / Click here for full PDF version

Author: Jovent Muliadi ; Anthony

- We recently got a lot of queries with regards to asset quality especially post 1Q results. We found that is much better than other SOEs.

- Other than usual LAR metric, we also use gross NPL formation to gauge the overall asset quality and found BNI is also at risk (other than ).

- As such, we believe is best to stick with and despite recent bull case for ahead of rate cut scenario.

Asset quality risk for seems to be overblown

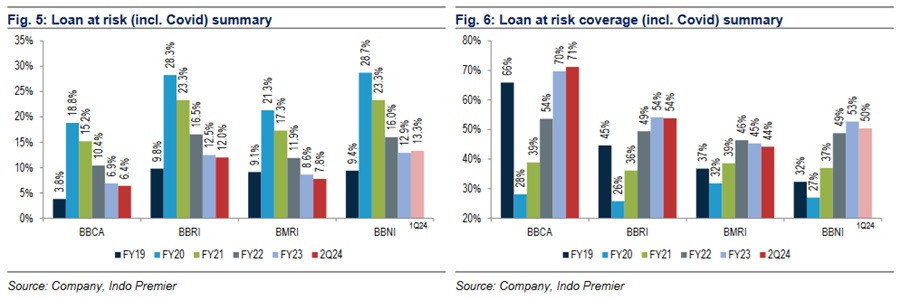

Asset quality was the key concern post 1Q results as we have seen myriad of NPL cycles i.e. , Jago Sharia, . was a particular concern for investors given that it has the highest loan growth of c.20% vs. peers of 11-16% and also faster commercial loan growth (NPL cycle in FY15-16); while was perceived to be safer given the slower loan growth (13% in 5M24) and shift to safer segments i.e. corporate private (from SOE) and consumer. However we found this isn't accurate as: 1) 's gross NPL formation continued to drop (lowest among SOE) and 2) similar LAR between corporate and commercial book at 8% (vs. blended LAR of 7.8% in 1H24).

We found that gross NPL formation to be superior compared to other SOE banks while we think there is budding risk on

Other than using usual NPL/LAR metric, we look at the gross NPL formation metric (new NPL and write-offs during that particular year) and found few interesting points: 1) 's gross NPL formation reached 6.2% in FY23 (6.4% in FY24F) from 4.4% in FY22 - 10Y high and even higher during Covid, this was the main reason why the CoC spiked this year; 2) 's gross NPL formation reached 3.7% in FY23 (4.8% in FY24F) up from 2.6% in FY21-22 (second highest after Covid period of 5.3%); 3) 's gross NPL formation was at 2.6% in FY23 (1.8% in FY24F, 2nd best only to BCA at 0.8-0.9%) and this is at 10Y low - note FY16 peak at 5.7%. This raised a concern that may need to increase its CoC next year, in our view.

Write-off is a good proxy to gauge on how clean the banks' books are

We were pleasantly surprised that 's bank-only write-off target this year only at c.Rp11tr vs. FY21/22/23's Rp13/14/18tr vs. 's write-off target of Rp18tr in FY24F vs. FY22/23's Rp11/14tr. This is counterintuitive as: 1) 's bank-only loan book stood at Rp1,196tr in 1H24 or 69% above 's loan book of Rp709tr in 5M24 and 2) if the overall loan book is clean (or getting better) the absolute amount of write-off is expected to be stable or dropping over time as reflected in and write-off number. Note that write-off stood Rp34tr in FY23 (Rp40tr in FY24F) vs. Rp22tr in FY22. Separately write off to recovery ratio stood at 58/50/35% in FY23 vs. 41/50/30% average FY18-22 for /BBRI/BBNI.

Maintain OW with and as our top picks

We continue to like the overall sector and prefer and as our top picks. Note throughout 1H we have been consistent with our picks on and , both have outperformed the sector. Our reasoning on is due to the fact most of the risks have been priced-in and any improvement on CoC will result in re-rating. We have all Buy rating for /BBRI/BBCA but Hold rating on as we believe the asset quality risk hasn't been priced-in. Risk to our call is that we understand our thesis may not play out in the short-term due to macro play (rate cut shall benefitted bank with tightest liquidity).

Sumber : IPS