Company Update / Coal / IJ / Click here for full PDF version

Author(s): Ryan Winipta ;Reggie Parengkuan

- 9M24 NP stood at Rp2.2tr (-23% yoy) above ours & consensus (80%/87% IPS/consensus) on robust operational performance.

- 3Q24 NP declined by 50% qoq to Rp651bn as forex gain in 2Q24 are reversed in 3Q24; but core NPAT remained at ~Rp1tr (flat qoq).

- Expect nickel ore and gold performance to remain robust in 4Q24F. Upgrade our TP to Rp2,000/share (from Rp1,750/share). Maintain Buy.

3Q24 review: robust nickel ore and gold performance

reported Rp2.2tr NP in 9M24 (-23% yoy) which came above ours and consensus forecast (80%/87% IPS/consensus) on robust operational performances in 3Q24 particularly from higher nickel ore ASP (+18% qoq) as a result of ore-shortage issue, and robust gold sales volume in 9M24 (+47% yoy; 76% of FY24F target). In 3Q24, revenue grew by +37% qoq to Rp20tr while gross profit also improved by +20% qoq driven by robust nickel ore & gold business performance. Opex slightly increased by +5% qoq to Rp768bn, while below operating line, reported a forex loss of Rp428bn in 3Q24 as USD/IDR trended lower by end of Sep24. Nevertheless, on core basis, NP stood at Rp1tr (flat qoq) in 3Q24.

Operational: elevated ore premium lifted nickel ore ASP

Nickel ore volume was flattish on qoq basis at 2.3mn wmt in 3Q24, however, its ASP grew significantly by +18% qoq to US$44/wmt, roughly c.25% higher than nickel ore benchmark price (HPM). Additionally, its gold trading volume also grew significantly to 405koz (+42% qoq) coupled with higher gold ASP of US$2.7k/oz (+15% qoq) while its net profit margin (excl. head office) grew by 40bps qoq to 6.2%. We estimated that FeNi business dragged 's NP in 3Q24 as nickel's NP contribution declined by -38% qoq despite higher Ni ore ASP, attributed to drop in FeNi volume by 28% qoq in addition to potentially higher cash costs in 3Q24.

WBN: dragged NP in 3Q24, but expect recovery in 4Q24F

WBN associate income also dragged down 's NP in 3Q24 as WBN managed to sold only 1.4mn wmt of nickel ore in 3Q24 vs. 6mn wmt in 2Q24 (-77% qoq) due to limited RKAB quota approval. Thus, we expect recovery in 4Q24F following recent approval of 32mn quota in FY24F/25F/26F, albeit lower than WBN's initial 40-42mn sales target.

Maintain Buy rating with a higher TP of Rp2,000/share

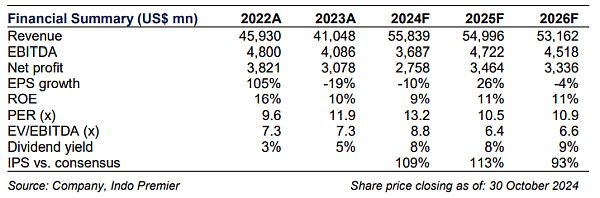

We upgrade our FY24F/25F/26F NP forecast by +10%/+3%/+4% as we are taking into account 9M24 achievement and sustained ore shortage outlook; We re-iterate our Buy rating as we raised our TP to Rp2,000/share (from Rp1,750/share), based on 14x 12-month forward P/E (3-year mean). Downside risks include decline in gold sales volume and lower ore premium.

Sumber : IPS