Company Update / Coal / IJ / Click here for full PDF version

Author(s): Reggie Parengkuan ;Ryan Winipta

- reported 9M24 NP of US$1.2bn (-3% yoy), which came above consensus but in-line with our forecast (77% IPS/92% consensus).

- 2Q24 NP stood at US$404mn (flat qoq), as higher thermal volume (+3% qoq) was offset by lower metallurgical volume/ASP (-22/-10% qoq).

- Maintain our FY24-26F NP estimates for now and reiterate our Hold rating at unchanged SOTP -based TP of Rp3,900/sh.

3Q24 NP was flattish qoq; soft metallurgical offsets robust thermal

reported 9M24 NP of US$1.2bn (-3% yoy), which came above consensus forecast but in-line with ours at 92%/77%, respectively. The NP beat against consensus was driven by consensus lagging to upgrade their estimates following strong 1H24 sales volume and NP beat (1H24 NP: 66% of FY24F consensus). In 3Q24, net profit stood at US$404mn (flat qoq) as slightly higher thermal sales volume (+3% qoq) and lower cash cost (-2% qoq) was offset by soft met-coal sales volume/ASP (-22/-10% qoq). Below operating line, US$24mn forex gain was recorded while associate income declined by -51% qoq to US$17mn due to BPI & MSW power-plant maintenance. On core basis, NP stood at US$373mn (-11% qoq).

Thermal volumes improved on drier weather; 9M24 in-line

Thermal production volume rose to 18Mt in 3Q24 (+11% qoq) amid seasonally drier weather. As a result, sales volume also ticked up to 17.5Mt (+3% qoq) - note that 2Q24 sales volume was a high base due to delayed shipment from 1Q24. Meanwhile, stripping ratio rose to 4.8x in 3Q24 (+11% qoq), likely due to pre-stripping activities. Overall, thermal 9M24 operational numbers remained largely in-line with our FY24F forecast.

Thermal ASP remained flat, while cash cost declined on mining cost

Thermal ASP was flattish qoq at US$70/t, in-line with ICI3 price (-1% qoq). On the other hand, thermal cash cost improved by 2% qoq to US$45/t despite higher thermal stripping ratio and opex (+17/+13% qoq). The cash costs improvement was primarily driven by lower mining cost per ton (-9% qoq) from lower fuel price (3Q24 crude oil: -7% qoq), in addition to lower coal processing cost per ton (-3% qoq). Overall, ASP and cash cost remained largely in-line at 99/98% respectively. Please seeour note on for more details on the coking coal business.

Reiterate Buy at unchanged SOTP -based TP of Rp3,900

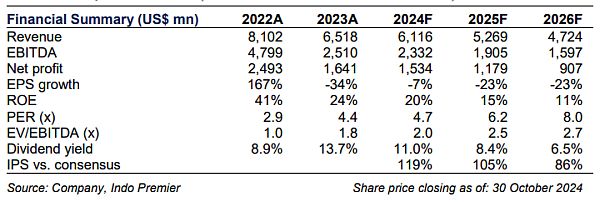

We maintain our Buy rating at unchanged SOTP -based TP of Rp3,900, pending on more details regarding AAI spin-off. is currently trading at 4.7x FY24F P/E (5% discount to ). Key catalyst for is potential royalty rate cut for IUPK holders, as we estimate c.2% EPS upside for every 1% royalty rate cut. Downside risk is softer than expected ICI price and MIP implementation (c.8-10% downside to FY25F NP).

Sumber : IPS