Company Update / Metals / / Click here for full PDF version

Author(s): Ryan Winipta ; Reggie Parengkuan

- HCC price declined significantly (-41% YTD) due to soft China steel demand while India steel growth (+8%) unable to offset China decline.

- Supply-disruption in Australia is the only upside, and without it, we think consensus FY24F NP is too high, based on our sensitivity analysis.

- Nonetheless, 's volume growth story has led to share price resiliency, similar to Warrior Met Coal. Maintain Buy rating.

What's behind hard coking-coal price decline?h

Australian hard coking coal (HCC) prices declined to US$187/t (-41% YTD), which is mainly due to soft economic situation in China and its real-estate market (c.40% steel demand), reflected in: 1) low iron ore price (-25% YTD) in addition to elevated inventories (Fig. 2), an indication of weak demand, 2) deteriorating profitability in steel mills (only c.5% of steel mills in China are profitable) as a result of rebar & HRC steel price decline, while 3) India steel demand growth (+8% YTD) were unable to fully offset the decline in China (c.50% steel production), Korea, and the US; note that India only accounts for c.10% of global steel production (Fig. 5).

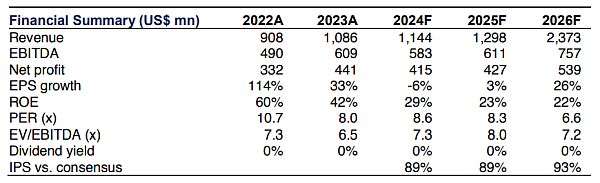

Sensitivity analysis vs. consensus FY24F forecast

As demand outlook remained bleak, we think the only ST upside to HCC price is the cyclone season in Australia (c.53% of global supply), potentially disrupting supply in Queensland & NSW, which may occur in Oct24 until 1Q25F. We conducted sensitivity analysis on FY24F NP vs. consensus (Fig. 1), and found that HCC prices need to avg. >US$230/t for the rest of FY24F; or at current HCC price (US$187/t), sales volume need to improve to 5.9Mt (vs. guidance of 4.9-5.4Mt) to beat estimate, which we think is less likely.

share price has remained resilient vs. HCC price

share price (-6% YTD) has been resilient in comparison to HCC price (Fig 6). Similarly, another regional player, Warrior Met Coal, has been resilient YTD (-7%) while Coronado underperformed (-38% YTD). Based on our observation, the primary difference between Coronado and /Warrior is lack of growth story as Warrior's Blue Creek could double its existing production vol. once operating at full capacity, similar to 's volume growth story (up to 6Mt in FY25F with potential of up to 8Mt).

Re-iterate Buy with an unchanged TP of Rp1,650/share

From tactical standpoint, we think would be interesting once we started to see recovery in coking-coal prices and steel demand as its share price resiliency is warranted due to its volume growth story. Hence, we maintain our Buy rating with an unchanged TP of Rp1,650/share. We also fine-tuned our FY24-26F NP forecast by +3%, taking into account better cash costs achievement in 1H24 (Fig. 8).

Sumber : IPS